Idea:

Use prediction markets; Simple, permissionless bets, to drive activity on Namada.

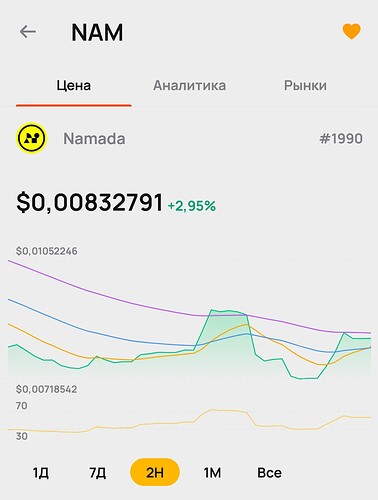

Think: “Will NAM be over $0.10 by August 1?” or “Will Proposal X pass?”

These markets:

-

Let users signal beliefs with capital

-

Create organic usage (speculation, hedging, signaling, fun)

-

Showcase Namada’s edge: private, on-chain bets — no public positions

Why it matters for Namada:

-

Brings in new users/builders

-

Drives both shielded and unshielded volume

-

Highlights privacy as a differentiator

How it works (today, no upgrade needed):

-

Two users agree on a bet

-

Funds go into a 2-of-3 multisig (Alice, Bob, Oracle)

-

Each pre-signs conditional transactions

-

Oracle signs the real outcome

-

Only the valid TX can be executed — winner takes all

Inspired by Bitcoin DLCs. Built on Namada’s existing tools: off-chain coordination + multisig + a signing oracle (e.g., TWAP from Osmosis or Neutron).

What I’m asking:

-

Does this sound interesting to you?

-

Would you use or help prototype something like this?

-

Any pitfalls or edge cases we’re missing?

Bonus: Could test with a Discord bot and soft incentives (“First 50 NAM bet is free”) to bootstrap usage.

Let me know if you’re in.

I’d love to hear feedback or team up on a simple proof of concept.