Excellent Validator Circle ![]() today. Grateful for so much engagement–the passion is energizing, thank you.

today. Grateful for so much engagement–the passion is energizing, thank you.

We discussed elements of this forum post, and I committed to writing this forum post to address the nam-only vs any-token gas fee model within the broader context of Namada’s long-term success and sustainability.

NAM utility is not a side concern–it will define whether or not Namada survives and thrives.

What’s the future of Namada, and why hold NAM?

Over time, as Namada’s adoption grows, NAM will generate meaningful value, and staked NAM should be able to capture some of that value. Our priority today is enabling that adoption: make Namada fast, safe, and secure at a foundational level, and expand to support more assets, chains, apps, wallets, and experimental features (like programmability). If you haven’t, check out this roadmap Namada - Roadmap ![]()

We* see two potential sources of fee revenue in Namada:

-

Gas fees (compute and storage)

-

Shielded pool (MASP) fees

Gas fees today can be paid in any token. That’s intentional—we want to make it as easy as possible for new users, wallets, and communities to onboard. Preventing spam/DoS matters, but in terms of revenue we don’t want to capture value at the edges (ie. gas for compute and storage), we want to capture value at the core–shielding.

Value Proposition

Namada’s MASP is the value engine. Privacy is our differentiator, and shielding is our product. So the MASP is where we should focus our value growth and capture efforts.

Shielded rewards are a bootstrapping mechanism, not a permanent subsidy. To provide shielding, there needs to be a target size for each asset in the pool, so we use NAM rewards to help establish that. But once a target is reached for a given asset, the job of the rewards is done, and at that point its incentives wind down.

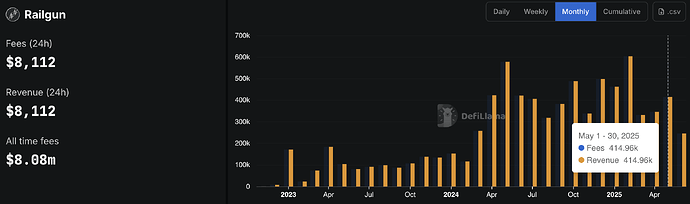

As the MASP becomes a trusted and widely used system, Namada will generate enough demand to charge for shielding. Railgun is already earning ~$400K/month from privacy fees

Our path to utility and value capture is clear, we just need to keep building and integrating. When the time is right (ie. when Namada is scaling rapidly), MASP deposits can involve a fee. This isn’t something we should activate yet, but this is the path:

-

A small percentage of each deposit goes to the protocol as revenue

-

Revenue is protocol managed: partly to buy NAM, and partly to pay NAM stakers

-

Fee policy will be governed by NAM stakers

Gas fees should remain small to avoid penalizing experimentation or usage. MASP fees would be a separate lever, introduced when the ecosystem is thriving.

Will Namada be a privacy service or platform?

It’s still early, but surfacing this longer-term strategic question.

If Namada is Privacy-as-a-Service, we’re a modular layer—apps, chains, and users plug in for shielding, and we monetize access. This seems to be most in line with “composable privacy” and the roadmap here: Namada - Roadmap

If Namada is Privacy-as-a-Platform, Namada becomes a place to build, with native apps, programmable primitives, and composable privacy. We can experiment with programmability–which will be a lot of fun–but we’ll only lean into it if we see clear traction.

The service vs platform distinction should shape how we think about long-term value capture, programmability, and ecosystem growth. But again, our focus right now must be on making Namada fast, safe, and widely integrated.

Marketing

Lastly, (yes!) marketing will matter more and more. Privacy doesn’t sell itself—people need to understand what’s possible and why it matters. Right now I think we should market our mission and vision by growing our intrinsically-aligned base of contributors–people energized by the mission, ready to weather unpredictable token prices. As Heliax makes Namada solid, we’ll need a coordinated effort to make Namada’s value proposition visible and grow demand.

I’ve opened a hot topic here. Let me know what I’ve missed or what you’d challenge, would love to hear your thoughts!

Fast chat → Discord

Lasting ideas → Forum (reply here!)

*writing on behalf of Knowable